tax shield formula excel

WACC Weightage of Equity Cost of Equity Weightage of Debt Cost of Debt 1 Tax Rate Based on the given information the WACC is 376 which is comfortably lower than the investment return of 55. IRR is an iterative function ie.

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Deduction Calculator Cheap Sale 50 Off Www Alucansa Com.

. When a company has debt the interest it pays on that debt that is tax-deductible creating interest tax shields that have value. Initial Investment CF1 1 IRR 1 CF2 1 IRR 2 CF3 1 IRR 3 CFn 1 IRR n. In the DCF analysis the ITS are baked in by including the tax-effected cost of debt in the WACC used to discount free cash flows FCF.

4800 8640 6912 and 5530. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest medical expenses charitable. And now you can get the sales tax easily.

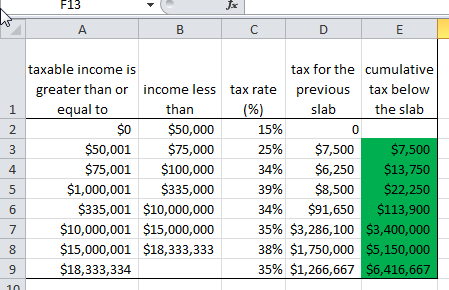

Actually you can apply the SUMPRODUCT function to quickly figure out the income tax for a certain income in ExcelPlease do as follows. 1In the tax table right click the first data row and select Insert from the context menu to add a blank rowSee screenshot. The tax savings are larger because there is a larger deduction.

Interest Tax Shield Interest Expense Tax Rate. Monday May 23 2022. If feasible the depreciation expense can be manually calculated by subtracting the salvage value ie.

Interest Tax Shield Example. All you get from CCA tax shields are the four numbers for. Depreciation Tax Shield Formula.

The effect of a tax shield can be determined using a formula. In some regions the tax is included in the price. Tax shield formula excel.

Tax Shield Deduction x Tax Rate. Tax Shield Deduction x Tax Rate. In this video on Tax Shield we are going to learn what is tax shield.

CF refers to periodic cash flows and initial investment means total amount invested in. The remaining asset value at the end of its useful life from the assets purchase price which is subsequently divided by the estimated useful. Select the cell you will place the sales tax at enter the formula E4-E4 1E2 E4 is the tax-inclusive price and E2 is the tax rate into it and press the Enter key.

How to calculate tax shield due to depreciation. Let us take the example of another company PQR Ltd which is planning to purchase equipment worth 30000 payable in 3 equal yearly installments and. C net initial investment T corporate tax rate k discount rate or time value of money d maximum rate of capital cost.

The expression CI CO D in the first equation represents the taxable income which when. Depreciation tax shield 30 x 50000 15000. In some regions the tax is included in the price.

This is usually the deduction multiplied by the tax rate. The value of a tax shield can be calculated as the total amount of the taxable interest expense multiplied by the tax rate. Of 2000 and the rate of tax is set at 10 the tax savings for the period is 200.

Capital Budgeting Formula C Not in the book. As such the shield is 8000000 x 10 x 35 280000. This is usually the deduction multiplied by the tax rate.

Its formula examples and calculation with practical examples𝐖𝐡𝐚𝐭 𝐢𝐬 𝐓𝐚𝐱 𝐒. Depreciation Tax Shield Depreciation Expense Tax Rate. That is why we dont have that line CCA tax shield anymore.

A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate. In the condition you can figure out the sales tax as follows. Hence it is a good idea to raise the money and invest.

How to calculate NPV. PRESENT VALUE OF TAX SHIELD FOR AMORTIZABLE ASSETS Present value of total tax shield from CCA for a new asset acquired after November 20 2018 𝐶𝑑𝑇 𝑑𝑘 115𝑘 1𝑘 Notation for above formula. 2Select the cell you will place the calculated result at enter the formula SUMPRODUCTC6C12-C5C11C1.

All you get from CCA tax shields are the four numbers for each year under CCAT. Weis summary C If salvage value S is less than UCC n. For instance if the tax rate is 210 and the company has 1m of interest expense the tax shield value of the interest expense is 210k 210 x 1m.

How to calculate after tax salvage valueCORRECTION. In the line for the initial cost. C If salvage value S is greater than UCC n.

A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest medical expenses charitable. This energy industry comps template provides a guideline and example of what a comparables universe would look like for a. For depreciation an accelerated depreciation method will also allocate more tax shield in earlier periods and less in later periods.

To learn more launch our free accounting and finance courses. The effect of a tax shield can be determined using a formula. Tax shield formula excel.

Therefore XYZ Ltd enjoyed a Tax shield of 12000 during FY2018. For more resources check out our business templates library to download numerous free Excel modeling PowerPoint presentation and Word document templates. The most important financing side effect is the interest tax shield ITS.

Excel tries different values until it reaches a value that fits the following equation.

Using Excel For Tax Calcs Jun 2019 Youtube

Wacc Diagram Explaining What It Is Cost Of Capital Financial Management Charts And Graphs

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Effective Tax Rate Formula Calculator Excel Template

Solved Using Excel To Find The Marginal Tax Rate Can Be Accomplis Chegg Com

Interest Tax Shield Formula And Excel Calculator

Excel Finance Class 58 After Tax Cash Flows After Tax Interest Rates Youtube

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples

Interest Tax Shield Formula And Excel Calculator

Excel Formula For Reverse Tax Calculation Excel Formula Reverse Excel

Array Formulas And Functions In Excel Examples And Guidelines Excel Excel Templates Microsoft Excel